Symmetry Financial Group is a U.S.-based insurance marketing organization that specializes in life insurance and retirement protection services. Established in 2009, the organization facilitates connections between agents and various insurance carriers, enabling them to provide clients with personalized coverage options. By utilizing a network of independent agents, Symmetry Financial Group has carved out a distinctive niche within the insurance sector, offering customized financial products nationwide.

Recently, the company has garnered attention due to legal challenges and disputes, prompting inquiries into its business practices, relationships with agents, and interactions with customers. These controversies, frequently highlighted in online reviews and legal discussions, have intensified scrutiny of the organization and brought the term “Symmetry Financial Group lawsuit” to the forefront. This article explores the specifics of the lawsuit, its potential consequences, and its implications for clients, agents, and the broader financial services industry.

Background of Symmetry Financial Group

History and Founding Information

Symmetry Financial Group was founded in 2009 by Casey Watkins, Brandon Ellison, and Brian Pope with the aim of transforming the insurance sales process. The founders aimed to foster a supportive atmosphere for independent insurance agents, implementing a commission-based model that provided agents with flexibility and opportunities for substantial income growth. With its headquarters in Swannanoa, North Carolina, Symmetry Financial Group has experienced rapid expansion, solidifying its position as a significant entity in the insurance marketing arena.

Overview of the Company’s Offerings and Target Audience

Symmetry Financial Group offers a wide array of insurance products, with a primary emphasis on life insurance, mortgage protection, and retirement solutions. The company functions as an insurance broker, collaborating with highly rated insurance providers to offer clients a range of policy options customized to their specific requirements. Symmetry targets individuals and families in search of financial stability, as well as independent agents seeking a versatile business framework. Through its network of independent agents, the company serves a varied clientele throughout the United States, assisting individuals and families in securing their financial futures.

What Is The Symmetry Financial Group Lawsuit?

Overview of the Alleged Lawsuit

The lawsuit involving Symmetry Financial Group pertains to claims associated with the company’s business practices, particularly regarding relationships with agents and interactions with clients. While the specifics may differ based on individual cases or allegations, reported lawsuits against Symmetry Financial Group have included issues related to compensation, contract stipulations, or claims of misrepresentation concerning the company’s business model. These matters have garnered attention due to the company’s swift expansion and its dependence on a network of independent agents, which can sometimes result in conflicts regarding expectations, support, and contractual responsibilities.

Primary Allegations in the Lawsuit (if available)

The allegations in the lawsuit generally focus on:

Compensation Discrepancies: Some agents have claimed that they were not adequately compensated for their efforts, alleging that commissions or bonuses were unexpectedly withheld or diminished.

Misrepresentation: Certain lawsuits have contended that Symmetry Financial Group misrepresented the nature of the opportunities or potential earnings available to agents, resulting in disappointment among those who joined with differing expectations.

Contractual Disputes: Allegations have also included issues related to contracts, with some agents or clients asserting that terms were not clearly articulated or were modified without appropriate communication or consent.

Official Statements from Symmetry Financial Group

In light of the allegations, Symmetry Financial Group has released statements refuting any misconduct, consistently underscoring its dedication to ethical business practices and transparency with both agents and clients. The organization has asserted that it places a high priority on compliance and adheres to all industry standards and regulations. Furthermore, they have emphasized their continuous support and training for agents, as well as maintaining open lines of communication for dispute resolution. Symmetry Financial Group encourages both agents and clients to communicate their concerns directly with the company to ensure a fair and transparent resolution process. Details Surrounding the Lawsuit

Description of Issues Leading to the Lawsuit

The lawsuit against Symmetry Financial Group reportedly arises from concerns related to its business model and practices involving independent agents. Several elements have contributed to the legal challenges, including agent dissatisfaction regarding compensation, allegations of unrealistic earnings expectations, and purported inconsistencies in contract terms. Moreover, issues surrounding compliance and transparency in the communication of these terms have been highlighted, resulting in frustration among some agents and clients who feel misled or inadequately informed about the company’s operations and potential earnings.

Parties Involved: Clients, Agents, or Other Companies

The primary parties engaged in the lawsuit consist of both former and current agents who have lodged complaints regarding their experiences with Symmetry Financial Group. In certain instances, clients have also participated, expressing dissatisfaction with policy terms, pricing, or the transparency of financial products. Additionally, some insurance carriers may become indirectly involved in these disputes, particularly if their policies or terms were referenced or impacted in the complaints.

Specific Allegations Against The Company

The lawsuit presents several specific allegations, including:

Unfulfilled Earnings Promises: Certain agents assert that Symmetry Financial Group guaranteed a high earning potential that was ultimately unattainable, resulting in claims of deceptive recruitment practices.

Compensation and Bonus Discrepancies: There are allegations regarding the withholding of commissions, unexpected deductions, and diminished bonuses, with agents contending that their compensation did not align with the original agreements.

Contractual Misrepresentation: Agents have claimed that Symmetry Financial Group failed to adequately communicate the terms of contracts or alter these terms without prior notification, which adversely impacted the agents’ roles and earnings.

Client Complaints: In various instances, clients have reported that the terms of policies were not thoroughly explained, or that product recommendations did not correspond with their needs or financial circumstances, raising issues of transparency and client-centricity.

These allegations highlight the concerns expressed by certain agents and clients regarding the company’s business practices, emphasizing issues that Symmetry Financial Group must address both legally and in terms of its reputation.

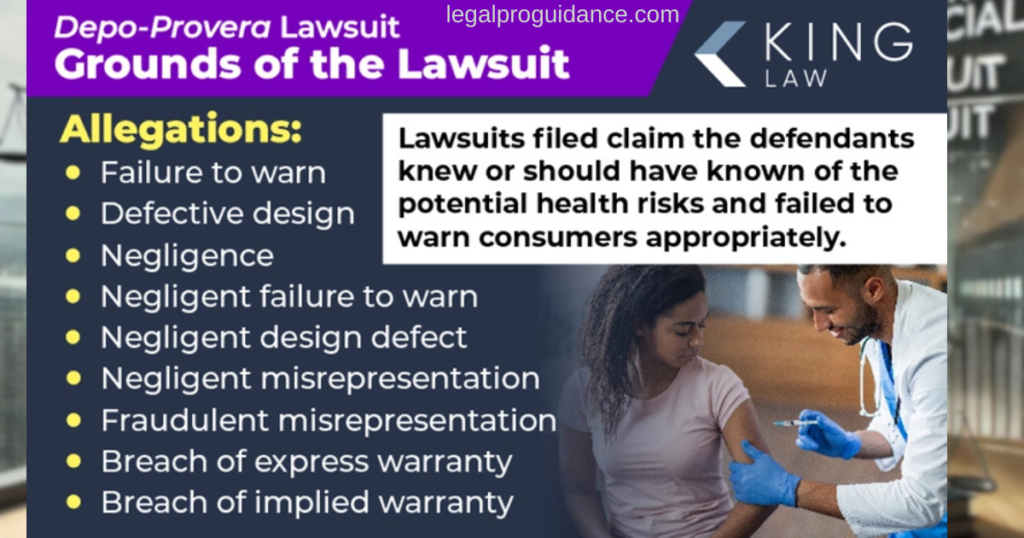

Legal Grounds of The Case

Overview of The Legal Basis For The Lawsuit

The lawsuit against Symmetry Financial Group is founded on multiple legal grounds, which encompass:

- Misrepresentation: Some agents and clients have alleged that Symmetry Financial Group shared inaccurate details regarding the expected earnings and the nature of the business opportunity. Allegations indicate that the company may have exaggerated earnings potential or misrepresented the simplicity of achieving success within the business model.

- Contractual Issues: Some agents allege that the company failed to honor contractual agreements concerning compensation, bonuses, and other earnings. Claims include ambiguous contract terms, sudden modifications to agreements, and the withholding of payments, which have resulted in contract disputes.

- Compliance Issues: There are allegations suggesting that Symmetry Financial Group may not have fully complied with certain regulatory or ethical standards within the insurance sector. These claims pertain to the company’s interactions with clients, particularly regarding the suitability of products and the clarity of policy terms, as well as adherence to standards concerning the treatment of agents.

Applicable Laws and Regulations

A variety of laws and regulations may be pertinent in such cases, contingent upon the details of each lawsuit:

- Consumer Protection Legislation: These laws are designed to shield clients from misleading practices. If clients were given inaccurate information regarding policy terms or if financial products were improperly recommended, consumer protection laws could be invoked.

- Employment and Contractual Law: Many of these disputes revolve around agent compensation and contractual obligations, making employment and contract law significant. These laws promote fair employment practices and require companies to uphold agreed-upon terms and compensation arrangements.

- Insurance Regulations: As an insurance agency, Symmetry Financial Group is obligated to comply with industry-specific regulations established by organizations such as the National Association of Insurance Commissioners (NAIC). These regulations necessitate transparency, ethical sales practices, and adherence to fair treatment standards for both agents and clients.

- These legal principles underpin the case, offering a structured basis for those seeking accountability from Symmetry Financial Group and highlighting the potential regulatory implications for the company’s business operations.

Effects on Clients and Agents

Implications of the Lawsuit for Current Clients

For current clients, the lawsuit may raise concerns regarding the reliability and transparency of the products and services offered by Symmetry Financial Group. Although the lawsuit itself may not have an immediate effect on their existing policies, clients might feel apprehensive about the company’s stability and its dedication to customer service. Clients may express concerns regarding the appropriateness of the products suggested to them if allegations of misrepresentation are proven valid. This situation could lead clients to reassess their policies with greater scrutiny or seek confirmation that their financial interests are adequately safeguarded.

Implications for Agents Associated with Symmetry Financial Group

The lawsuit carries several important ramifications for agents connected to Symmetry Financial Group:

- Agent Retention and Morale: Claims of misrepresentation and disputes over compensation may adversely affect agent morale and their trust in the organization. Agents might begin to question the long-term prospects of their association with Symmetry and experience uncertainty regarding the stability of their earnings.

- Reputation and Client Relationships: Agents linked to Symmetry Financial Group may encounter reputational challenges in their interactions with clients, as heightened public awareness of the lawsuit could result in difficult discussions or reluctance from potential clients. Agents may need to exert additional effort to establish trust and showcase their dedication to ethical conduct.

- Future Business Opportunities: For agents contemplating a career with Symmetry, this lawsuit could influence their decision-making, especially if there are uncertainties surrounding compensation practices or contract conditions. It may also hinder recruitment initiatives, as prospective agents might be reluctant to join amidst ongoing legal and reputational issues.

- The lawsuit’s effects on both clients and agents highlight the necessity for transparent communication and ethical business practices within the insurance sector, as these factors can profoundly impact relationships and trust among all parties involved.

Symmetry Financial Group’s Response to the Lawsuit

Public Statements, Responses, or Defenses Made by the Company

In light of the lawsuit, Symmetry Financial Group has categorically denied any misconduct and asserts that its business operations comply with ethical standards and industry regulations. The organization has responded to several allegations, asserting its dedication to offering agents clear information regarding compensation, potential earnings, and contractual responsibilities. Symmetry Financial Group has conveyed confidence in its operational model, highlighting that its success and expansion are founded on a nurturing and adaptable environment for agents.

Additionally, the company has pointed out that some complaints may arise from misconceptions about commission-based income in the insurance sector, where earnings can fluctuate significantly based on sales performance. In its public communications, Symmetry Financial Group has emphasized its commitment to transparency and accountability, promoting an open dialogue with agents and clients to address issues swiftly.

Measures Implemented by Symmetry Financial Group to Alleviate Concerns

To tackle concerns and strengthen trust, Symmetry Financial Group has undertaken various initiatives, which may encompass:

- Improved Training and Support: The organization has reportedly enhanced its training programs to assist agents in grasping the intricacies of commission-based earnings, contract stipulations, and product offerings. This strategy aims to ensure that agents possess realistic expectations and can effectively communicate with clients.

- Clarification of Contract Terms: Symmetry Financial Group has made strides to elucidate contract specifics, earnings frameworks, and commission policies to prevent misunderstandings. These enhancements are designed to provide agents with a clearer understanding of income potential and the factors influencing it.

- Dedicated Customer Support and Resolution Channels: The company has established specific channels for agents and clients to report and resolve issues more effectively. Symmetry Financial Group has encouraged any dissatisfied individuals to reach out directly, reaffirming its commitment to equitable resolutions.

These initiatives reflect Symmetry Financial Group’s aim to uphold its reputation and foster stronger relationships with both agents and clients.

The company’s statement highlights a proactive strategy aimed at resolving any misunderstandings or disputes, intending to provide reassurance to all stakeholders involved.

Industry Reactions to the Lawsuit

Responses from Competitors and Other Industry Professionals

The lawsuit against Symmetry Financial Group has attracted considerable attention from competitors and industry experts. Many competitors view the lawsuit as a chance to showcase their business methodologies, often contrasting their practices regarding agent support, compensation transparency, and client relations with those of Symmetry. Some have tactfully utilized the situation in their marketing efforts, underscoring their dedication to ethical standards and transparency to appeal to agents who may feel disenchanted by the ongoing controversy surrounding Symmetry.

Industry experts, including insurance analysts and advisors, have noted that the lawsuit highlights broader issues within the insurance marketing sector, where independent agents frequently encounter varying degrees of support and clarity regarding contractual agreements. Professionals in the industry have remarked that such conflicts emphasize the necessity for companies to uphold consistent and transparent practices to foster both agent loyalty and client trust.

Impact on the Company’s Reputation in the Industry

The lawsuit has adversely affected Symmetry Financial Group’s reputation, raising concerns about the company’s operational practices and diminishing its perceived reliability within the industry. As the legal proceedings continue, the lawsuit has prompted inquiries into the company’s commitment to transparency, which may undermine its credibility among potential agents and clients. This situation could discourage prospective agents from joining, as they may prefer companies with more established reputations for clarity and ethical conduct.

Clients are experiencing uncertainty regarding the reliability and appropriateness of financial products recommended by agents from Symmetry due to the current situation. This concern is compounded by the potential repercussions of the lawsuit, which may lead insurance carriers to reconsider their partnerships with a company under public scrutiny.

Although Symmetry Financial Group has implemented measures to address reputational harm, the long-term implications will largely hinge on the lawsuit’s outcome and the company’s capacity to restore trust within the industry. This case underscores the vital necessity of maintaining consistent ethical practices and transparency as essential components for preserving credibility in the competitive financial services sector.

Potential Outcomes of the Lawsuit

Possible Rulings or Settlements

The outcome of the lawsuit against Symmetry Financial Group will depend on the particular claims made and the legal procedures followed. Key possibilities include:

- 1. Dismissal of the Case: Should the court determine that there is insufficient evidence to substantiate the claims, the case may be dismissed, exonerating Symmetry. This outcome would enable the company to proceed without significant operational alterations, although it may still experience residual reputational effects.

- 2. Settlement Agreement: Symmetry Financial Group might opt to resolve the lawsuit through an out-of-court settlement to circumvent extended legal disputes and further reputational harm. Such a settlement would likely involve financial compensation for the affected parties and may necessitate specific operational modifications by the company.

- 3. Court Ruling Against Symmetry: If the case advances and the court rules unfavorably for Symmetry Financial Group, the company could incur financial penalties, be required to implement mandatory changes to its agent agreements, and face heightened regulatory scrutiny. This ruling could have a more profound effect on its reputation and operations, potentially compelling the company to amend its practices and policies to prevent future legal complications.

The Potential Effects of These Outcomes on the Company’s Operations

The resolution of the lawsuit may result in significant alterations to the operations of Symmetry Financial Group, which could include:

- Revisions to Policies and Contracts: To mitigate the risk of similar issues arising in the future, Symmetry may choose to amend agent contracts, compensation frameworks, and disclosure protocols. By establishing clearer terms and enhancing transparency, the company can better safeguard itself legally while also fostering greater trust among agents.

- Strengthened Compliance and Oversight: A judgment unfavorable to Symmetry or a settlement may necessitate the implementation of more robust compliance measures. This could entail the recruitment of additional compliance personnel, the enhancement of agent training programs, or the establishment of stricter standards for client interactions.

- Reputation Restoration Initiatives: Regardless of the lawsuit’s outcome, Symmetry Financial Group may find it essential to invest in efforts to restore its brand reputation. This could involve launching public relations campaigns, showcasing positive experiences from clients and agents, and emphasizing the company’s dedication to ethical practices. Such initiatives may be crucial for regaining the confidence of agents, clients, and industry partners.

- Financial Consequences: Should the lawsuit result in financial penalties or settlement expenses, Symmetry Financial Group may face temporary financial challenges. Additionally, the company could incur higher operational costs if new compliance mandates are imposed.

The influence of these outcomes on Symmetry’s future will largely hinge on the company’s capacity to effectively implement necessary changes and restore trust among agents, clients, and industry stakeholders.

Conclusion

The lawsuit involving Symmetry Financial Group has underscored significant concerns regarding transparency, agent relationships, and business practices within the insurance sector. For Symmetry, this case represents a pivotal moment, presenting both challenges and opportunities to enhance its operational standards and rebuild trust with agents and clients alike. The potential outcomes—whether dismissal, settlement or otherwise—will play a crucial role in shaping the company’s path forward. The possible results—ranging from dismissal, and settlement, to a court decision—will influence the company’s future strategies regarding compliance, clarity in contracts, and adherence to ethical standards.

FAQs

What is the Symmetry Financial Group lawsuit about?

The lawsuit against Symmetry Financial Group encompasses allegations from agents and clients concerning misrepresentation, disputes over compensation, and the terms of contracts. Some former agents claim that the company misrepresented potential earnings and compensation frameworks, while certain clients express concerns regarding the transparency and appropriateness of the products recommended to them.

How does the lawsuit affect Symmetry Financial Group’s clients?

Although the lawsuit primarily targets agents, it may prompt some clients to reassess the dependability of Symmetry’s services. Nevertheless, the existing policies and coverage for clients remain intact despite the lawsuit, although clients may seek reassurance regarding the transparency and support provided by the company.

What are the main complaints from agents involved in the lawsuit?

Agents participating in the lawsuit have voiced grievances regarding compensation, claiming that the earnings promised were not realized and that commissions were either withheld or diminished. Additionally, there are complaints about ambiguous contract terms and inconsistencies between anticipated and actual income.

Has Symmetry Financial Group made any public statements about the lawsuit?

Indeed, Symmetry Financial Group has publicly refuted any allegations of misconduct, maintaining that it follows ethical business practices and transparent compensation policies. The company has reiterated its commitment to both agents and clients, promoting open dialogue to resolve any concerns directly.

What could happen if Symmetry Financial Group loses the lawsuit?

Should the court rule unfavorably for Symmetry, the company may incur financial penalties, be mandated to compensate affected agents or clients, and may need to revise its contracts, policies, and compliance measures to prevent similar issues in the future.

Will this lawsuit affect the reputation of Symmetry Financial Group?

The ongoing lawsuit has indeed impacted Symmetry’s reputation, particularly among agents and potential clients who may approach the company with caution due to the surrounding controversy. Nevertheless, the organization is diligently striving to uphold trust through enhanced transparency and improved communication strategies, which could facilitate the gradual restoration of its reputation.

Is it advisable to engage with Symmetry Financial Group in light of the lawsuit?

Symmetry Financial Group continues to operate and sustain its relationships with reputable insurance carriers. For agents or clients contemplating a partnership with Symmetry, it is crucial to thoroughly examine all contractual details and engage in candid discussions with the company to gain a comprehensive understanding of compensation structures and policy conditions.

How can I keep informed about the Symmetry Financial Group lawsuit?

To remain informed about the lawsuit, you may follow legal news outlets, financial services news, and publications within the insurance sector. Additionally, Symmetry Financial Group may issue public statements on its website or social media platforms when significant developments occur.

Thank you for visiting our Blog! For more engaging content, please feel free to explore the website.