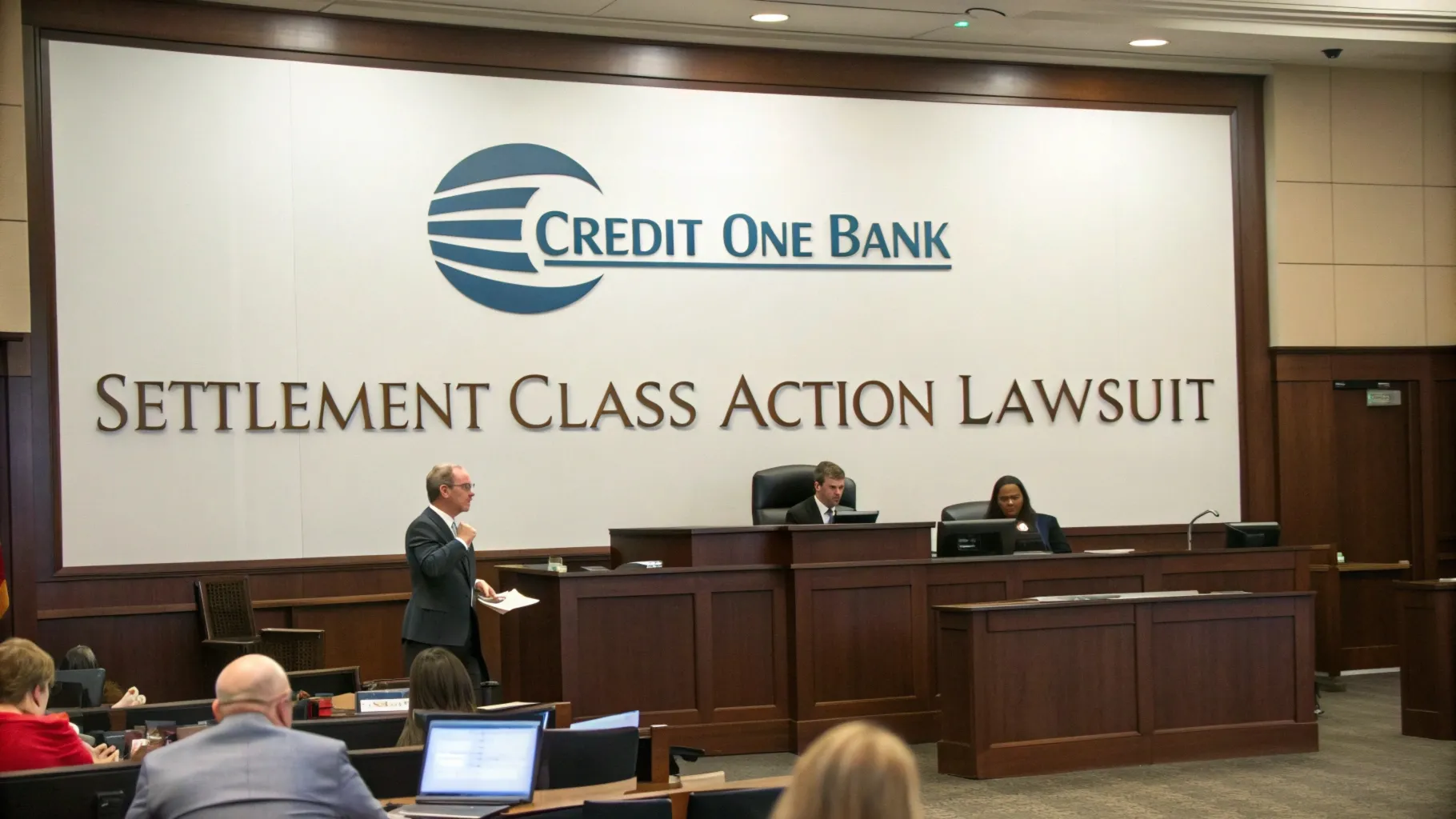

Credit One Bank, a major credit card issuer in the U.S., is facing a class action lawsuit. This lawsuit has big implications for consumer rights and how the industry operates. It was recently settled, revealing unfair lending practices and violations of consumer protection.

This lawsuit shows the strength of coming together to fight for justice. It makes it clear that financial institutions must be held responsible for their actions. This case is a call to action for consumers and lawmakers, showing the need for better protection and a fair financial system.

Key Takeaways:

- The Credit One Bank settlement class action lawsuit exposed unfair lending practices and consumer protection violations.

- The lawsuit highlights the importance of collective action and holding financial institutions accountable.

- The settlement has the potential to drive industry-wide changes to protect consumer rights and promote transparency.

- Consumers may be eligible for compensation and credit report corrections under the terms of the settlement.

- The role of the Consumer Financial Protection Bureau in the settlement underscores the agency’s commitment to safeguarding consumer interests.

Understanding the Credit One Bank Settlement Class Action Lawsuit

A class action lawsuit against Credit One Bank has brought to light unfair lending practices and predatory claims. The lawsuit was filed on behalf of consumers. It has revealed a disturbing pattern of behavior that affects those dealing with credit card debt.

Key Allegations Against Credit One Bank

The lawsuit claims Credit One Bank used unfair lending practices, including:

- Misleading consumers about their credit card terms and conditions

- Charging too many fees and high interest rates

- Using abusive debt collection methods, like constant phone calls and threats

- Not properly handling credit report disputes

Timeline of Legal Proceedings

The lawsuit against Credit One Bank has been ongoing for years. Key moments include:

- The lawsuit was first filed in 2018, accusing Credit One Bank of breaking consumer protection laws

- In 2020, the class action was certified, allowing the case to move forward for affected consumers

- Since then, there have been ongoing negotiations and discovery, leading to a proposed settlement in 2022

Parties Involved in the Lawsuit

The main parties in the Credit One Bank settlement class action lawsuit are:

| Plaintiffs | Defendants |

|---|---|

| Consumers who held Credit One Bank credit cards and were allegedly subjected to unfair lending practices | Credit One Bank, the financial institution accused of the predatory claims |

The outcome of this case will greatly impact consumers and the credit card industry.

Impact of Unfair Lending Practices on Consumers

The lawsuit against Credit One Bank shows how unfair lending affects people’s money. High credit card fees, tricky terms, and tough debt collection are big problems. These issues show why we need better protection for consumers.

People had to deal with huge fees hidden in small print. These fees cut down their money for buying things and made their budgets tight. Credit One Bank’s credit card fees and charges were made to make more money, not help customers. This left many people struggling to pay their bills.

“The aggressive debt collection practices by Credit One Bank have caused a lot of stress and money problems for many people.”

Unfair lending also hurts people’s credit scores and their financial health. Mistakes in credit reports and harsh tactics can hurt a person’s credit. This makes it hard to get loans, mortgages, or even jobs later on.

The Credit One Bank lawsuit shows we need stronger rules to protect people. We need a fair and clear lending system. By fixing these problems, we can help people trust the financial world again.

Legal Basis for the Class Action Settlement

The Credit One Bank settlement was based on solid legal grounds. It was built on violations of important consumer protection laws. The bank was accused of unfair and deceptive practices against its customers.

Violations of Consumer Protection Laws

The lawsuit said Credit One Bank broke several consumer financial laws. These included the Fair Credit Reporting Act and the Consumer Financial Protection Act. These laws protect consumers from unfair lending and ensure financial services are fair and transparent.

Fair Credit Reporting Act Implications

The Fair Credit Reporting Act requires credit card companies to report consumer info correctly. The lawsuit claimed Credit One Bank broke this by reporting wrong info and using unfair debt collection methods. This was a big violation of consumer rights.

Settlement Terms and Conditions

The settlement between the plaintiffs and Credit One Bank aimed to help affected consumers. It included money payments, debt relief, and fixing credit report errors. These steps were to fix the financial and credit problems faced by class members.

This settlement aimed to make Credit One Bank responsible for its actions. It also protected the rights of consumers who faced unfair lending practices.

Eligibility Requirements for Settlement Claims

The lawsuit against Credit One Bank aims to help those affected by unfair lending. It’s important to know if you qualify to join the settlement. This way, you might get compensation or help with your debt.

To qualify for the Credit One Bank settlement, you need to meet certain criteria:

- Held a Credit One Bank credit card account at any point between January 1, 2010, and the present date.

- Experienced issues such as unauthorized account openings, improper credit reporting, or abusive debt collection tactics by Credit One Bank.

- Did not opt out of the class action lawsuit or previously release their claims against the bank.

The settlement also includes those denied a Credit One Bank credit card unfairly. If you think you were denied because of your race or ethnicity, you might be eligible too.

| Eligibility Criteria | Details |

|---|---|

| Account Holder Status | Current or former Credit One Bank credit card account holder |

| Time Frame | January 1, 2010, to the present |

| Alleged Wrongdoing | Unauthorized account openings, improper credit reporting, abusive debt collection tactics, or discriminatory lending practices |

| Opt-out Status | Did not opt-out of the class action lawsuit or previously release claims against Credit One Bank |

It’s crucial to check the settlement details and criteria to see if you qualify. The class action against Credit One Bank is a chance for consumers to protect their rights. It could also lead to credit card debt settlement relief.

Compensation and Relief Options Available

The Credit One Bank settlement class action lawsuit offers many ways to help affected consumers. It aims to fix the harm caused by the bank’s unfair credit reporting and debt collection.

Monetary Compensation Details

Eligible class members might get cash payments. The amount depends on how much harm the consumer faces and how many claims are filed. These payments are meant to help those hurt by Credit One Bank’s wrong actions.

Debt Relief Programs

The settlement also offers debt relief programs. These can help reduce or wipe out what’s owed to Credit One Bank. This lets consumers start fresh and rebuild their financial health.

Credit Report Corrections

The settlement also fixes unfair credit reporting. Consumers can ask Credit One Bank to correct any wrong information on their credit reports. This can greatly help their ability to get credit, find jobs, or get other financial services.

| Compensation and Relief Option | Description | Potential Benefits |

|---|---|---|

| Monetary Compensation | Cash payments to eligible class members | Provides direct financial relief for those impacted by unfair practices |

| Debt Relief Programs | Partial or full debt forgiveness from Credit One Bank | Helps consumers regain financial stability and rebuild their credit |

| Credit Report Corrections | Removal of inaccurate or negative information from credit reports | Improves consumers’ ability to access credit, employment, and other financial services |

The Credit One Bank settlement aims to give real help to those affected. It targets unfair lending practices, unfair credit reporting, and other law violations.

Filing Process and Important Deadlines

If Credit One Bank’s unfair lending practices affected you, you might be part of a class action settlement. The filing process needs careful attention and meeting key deadlines. Let’s explore the steps to ensure your claim is successfully submitted.

Gathering Required Documentation

To file a claim, you’ll need to provide certain documents:

- Proof of your Credit One Bank account, such as account statements or correspondence

- Documentation related to any fees or charges you incurred due to the bank’s alleged misconduct

- Evidence of any negative impact on your credit score or credit report

Submission Methods and Deadlines

There are several ways to submit your claim for the class action litigation settlement:

- Online: Visit the settlement website and follow the instructions to file your claim electronically.

- By mail: Print and complete the claim form, then mail it along with the required documentation to the address provided.

- By fax: Fax the completed claim form and supporting documents to the designated fax number.

All claims must be submitted or postmarked by the deadline date to be eligible. Missing this deadline may lead to your claim being rejected.

Navigating the Process with Ease

To make the filing process smooth and increase your chances of getting compensation, consider these tips:

- Review the settlement website thoroughly for instructions and updates

- Gather all required documentation well in advance of the deadline

- Submit your claim early to avoid any last-minute delays or issues

- Contact the settlement administrator if you have any questions or concerns

By following these steps and staying vigilant, you can navigate the consumer rights advocacy process with confidence. This way, you might receive the compensation or relief you’re entitled to.

Changes in Credit One Bank’s Policies Post-Settlement

The class action lawsuit against Credit One Bank has led to big changes. The company has made new rules to protect consumers better. They also changed how they collect debts.

New Consumer Protection Measures

Credit One Bank has added new ways to protect customers. These steps help avoid breaking consumer financial protection laws. Here are some of the new measures:

- They now share more details with customers about their accounts.

- It’s easier for customers to solve problems with their credit reports.

- Staff are getting better training on how to collect debts the right way.

Reformed Debt Collection Practices

The settlement also made Credit One Bank change how they collect debts. They’ve made big improvements to stop improper debt collection tactics. Here are the main changes:

- They follow the Fair Debt Collection Practices Act closely.

- They stopped using aggressive methods like too many calls or threats.

- They have a new way to check and fix any debt collection problems.

These changes show Credit One Bank wants to regain the trust of its customers. They’re making sure they follow all the laws to protect consumers.

| Policy Changes | Key Highlights |

|---|---|

| Enhanced Transparency | Clear disclosures on account terms and conditions |

| Improved Dispute Resolution | Easier process for consumers to address FCRA violations |

| Ethical Debt Collection | Adherence to FDCPA and elimination of improper tactics |

Impact on Future Credit Card Industry Practices

The settlement between Credit One Bank and the class action plaintiffs could lead to big changes in the credit card world. As protecting consumer rights becomes more important, the industry will likely face more checks and balances. This could mean more rules and oversight in the future.

The way credit card fees and charges are handled might change a lot. The claims against Credit One Bank have shown the need for clearer and fairer fees. This could lead to new rules or laws to protect consumers from unfair practices.

- Enhanced consumer disclosure requirements for credit card terms and conditions

- Stricter limits on penalty fees and interest rate hikes

- Mandatory credit counseling and debt management programs for at-risk borrowers

Also, other credit card companies might look at their own practices more closely. They might make changes to avoid legal trouble and keep customers’ trust. This is because they expect more consumer rights protection in the future.

| Potential Industry Reforms | Benefit to Consumers |

|---|---|

| Enhanced credit card fee transparency | Better understanding of true cost of credit |

| Reduced penalty fees and interest rates | Lower overall borrowing costs |

| Expanded credit counseling and debt relief programs | Improved financial literacy and debt management |

The Credit One Bank settlement might lead to bigger changes in the credit card world. It shows the importance of protecting consumers and being fair. As the credit card industry grows, we can expect a more open and fair place for users.

Role of the Consumer Financial Protection Bureau in the Settlement

The Consumer Financial Protection Bureau (CFPB) was key in the Credit One Bank settlement. It acted as a watchful eye against unfair lending. The agency found many consumer rights violations, leading to the settlement.

The CFPB focused on protecting consumer finances. It tackled unfair lending practices by Credit One Bank. This showed its strong support for consumer rights advocacy. The settlement aimed to help those affected and change the credit card industry for the better.

| CFPB’s Role | Key Achievements |

|---|---|

| Investigation and Enforcement | – Found unfair lending practices by Credit One Bank – Took action to make the bank responsible |

| Settlement Negotiations | – Got a detailed settlement to protect consumer finances – Got money, debt help, and credit fixes for those affected |

| Ongoing Oversight | – Watched Credit One Bank’s reforms – Made sure they followed the settlement |

The CFPB’s work in the Credit One Bank case shows its important role. It protects consumer financial protection and fights unfair lending practices. The agency uses its power to make sure banks are fair and help those who were wronged.

Lessons Learned for Credit Card Users

The Credit One Bank settlement case teaches us important lessons. It shows how to protect our consumer rights and deal with financial issues from credit card companies. Knowing these lessons can help us spot and fix unfair lending, credit reporting problems, and debt disputes.

Recognize Unfair Practices

It’s crucial to watch your credit card statements and reports for any odd fees, high interest, or wrong info. Learning about the Fair Credit Reporting Act and other laws helps us spot and fight Fair Credit Reporting Act violations.

Proactively Manage Debt

If you’re struggling financially, talk to your lender and look into credit card debt settlement. Being proactive can lead to better deals, protect your credit, and help you take back control of your money.

Seek Professional Assistance

If you have disputes or issues with credit card companies, get help from financial advisors, advocacy groups, or lawyers who know consumer rights protection laws. They can guide you through the legal maze and make sure your rights are protected.

By learning these lessons, credit card users can better handle the credit card world. They can protect their financial health and stay ahead of industry changes.

| Key Lesson | Importance |

|---|---|

| Recognize Unfair Practices | Identify and challenge violations of consumer protection laws, such as the Fair Credit Reporting Act. |

| Proactively Manage Debt | Explore debt settlement options and maintain open communication with lenders to regain control of one’s financial situation. |

| Seek Professional Assistance | Consult with financial counselors, consumer advocates, or attorneys to navigate complex legal issues and protect one’s consumer rights. |

“By understanding the key takeaways from this landmark lawsuit, individuals can empower themselves to recognize and address unfair lending practices, credit reporting issues, and debt settlement disputes.”

Conclusion

The Credit One Bank settlement class action lawsuit has sent a strong message to the credit card industry. It shows how important consumer protection and fair lending are. This case has helped those affected and opened the door for bigger changes that can help many Americans.

The Consumer Financial Protection Bureau’s part in this settlement shows how key government agencies are in protecting our rights. Credit One Bank has made big changes, like better consumer protection and fairer debt collection. These changes show the power of legal action and the commitment to fair financial practices.

We, as consumers, need to stay alert and fight for our rights. This case teaches us that being careful, working together, and standing up for financial justice can lead to real change. By knowing our rights and using legal options, we can help make the credit card industry fairer and more focused on our well-being.

FAQ About Credit One Bank Settlement Class Action Lawsuit

What is the Credit One Bank Settlement Class Action Lawsuit?

The Credit One Bank Settlement Class Action Lawsuit is a legal case. It claims Credit One Bank used unfair lending practices. It also says the bank broke consumer protection laws and treated customers unfairly. The lawsuit aims to give compensation and relief to affected customers.

What were the key allegations against Credit One Bank?

The lawsuit accused Credit One Bank of many unfair practices. These include charging too much in fees, using misleading terms, and being too aggressive in debt collection. The bank was also said to have broken the Fair Credit Reporting Act and other laws.

How did the unfair lending practices impact consumers?

Credit One Bank’s actions hurt consumers a lot. They damaged credit scores, charged unfair fees, and caused financial stress. This made life harder for many people.

What was the legal basis for the class action settlement?

The lawsuit was based on Credit One Bank breaking consumer protection laws. The settlement was made to give relief and compensation to affected customers.

Who is eligible to participate in the settlement?

To join the settlement, you must meet certain criteria. This includes being a Credit One Bank account holder and experiencing unfair practices. The settlement details explain who can participate.

What types of compensation and relief are available through the settlement?

The settlement offers money, debt relief, and credit report fixes. These help fix the harm caused by Credit One Bank’s actions.

What is the process for filing a claim in the settlement?

To file a claim, you need to submit documents and meet deadlines. The settlement provides clear instructions to help you.

How have Credit One Bank’s policies and practices changed after the settlement?

After the settlement, Credit One Bank made big changes. It now has better consumer protection and fairer debt collection practices.

What is the potential impact of the Credit One Bank settlement on the broader credit card industry?

The settlement could make the credit card industry more careful. It might lead to stricter rules, better consumer protection, and fairer lending.

What role did the Consumer Financial Protection Bureau play in the Credit One Bank settlement?

The Consumer Financial Protection Bureau (CFPB) helped a lot. It looked into Credit One Bank’s actions and helped make the settlement. This ensured fair treatment for consumers.

What key lessons can credit card users learn from the Credit One Bank settlement?

The Credit One Bank case teaches us to be careful and know our rights. It shows how important it is to stand up for ourselves and seek help when needed. It also shows the strength of working together to solve big problems.